The Value of Health Plan Networks

One of the most misunderstood and most important parts of health insurance and health care, generally, is the role of “provider networks” – a system of doctors, hospitals, and other providers that health plans have contracted with to provide health care services for their enrollees.

One of the most misunderstood and most important parts of health insurance and health care, generally, is the role of “provider networks” – a system of doctors, hospitals, and other providers that health plans have contracted with to provide health care services for their enrollees.

Health plans create provider networks by establishing agreements with a wide range of providers and facilities: doctors (including primary care-type physicians and specialists), hospitals, labs, radiology facilities, pharmacies and other providers. It is estimated that approximately 90 percent of U.S. providers (hospitals and doctors) participate in health plan networks. For providers, these agreements include commitments to participate in plans’ quality and utilization management programs and to accept contracted rates as payment in full for covered services, in exchange for the volume of covered patients and administrative efficiencies.

Health plans develop provider networks that offer consumers and employers access to affordable, high-quality care. Some insurance products include broad networks that open up the network to a larger number of providers. Others include high- value networks, sometimes called narrow networks, which limit the network to high-performing and high-value hospitals and providers. A broad network usually means a more expensive health insurance premium, while high-value networks tend to have more affordable premiums. Regardless of network size, all health plans must meet federal and state regulations for network adequacy for health coverage.

Efforts by health plans to achieve high-quality provider networks are making a positive difference, according to research from Kaiser Family Foundation. A poll released by Kaiser finds that 9 out of 10 insured Americans are satisfied with their choices of doctors and the value of their health plans.

Health Plan Networks Resources:

The Value of Health Plan Networks

A resource guide on health plan networks.

April 2016

Provider networks help contain health care costs, because health plans can use private market competition to negotiate better prices with doctors and hospitals in the network. Health insurance premiums track directly with the underlying cost of care. As a result, lower prices from network providers mean that employers and individuals pay less in premiums and other charges.

Consumers Voice Strong Approval of Health Plan Networks

A fact sheet on consumer satisfaction of their health plan networks.

April 2016

A poll released by Kaiser Family Foundation finds that 9 out of 10 insured Americans are satisfied with their choices of doctors and the value of their health plans. Those choices are made possible through carefully assembled provider networks—a system of physicians, facilities and other providers that health plans develop to deliver affordable, accessible, quality medical care to their consumers.

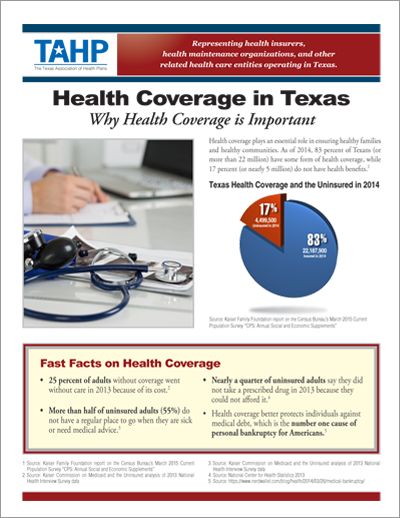

Health Coverage in Texas: Why Health Coverage is Important

A resource guide on health coverage in Texas.

April 2016

Today, federal law requires most people to have a health insurance plan that meets minimum federal coverage standards or pay a tax penalty. Health benefit plans provided by employers and most state or federal government health plans (Medicare, Medicaid, CHIP, TRICARE, and some veterans’ health programs) will usually satisfy the requirement.

Texas Department of Insurance: Balance Billing

A fact sheet on balance billing, health plan network and transparency requirements, and mediation.

June 2016

This report, provided by the Texas Department of Insurance, contains a Texas insurance coverage market overview, as well as balance billing laws and regulations to include transparency requirements, network standards, and payment standards.

TAHP Testimony to House Insurance Committee

Presentation on balance billing and solutions to protect consumers.

June 2016

TAHP’s presentation to the House Insurance Committee explains that surprise billing is still a problem in out-of-network emergency care, and mediation needs to be expanded. In addition, more transparency is needed because the system is still too confusing to consumers.

Texas Department of Insurance Testimony to House Insurance Committee

Presentation on balance billing and solutions to protect consumers.

June 2016

TDI’s presentation covers better consumer protections against balance billing in the form of transparency requirements, payment standards, mediation, and network adequacy standards.

TAHP Testimony to Senate Business and Commerce Committee

Presentation on balance billing and solutions to protect consumers.

May 2016

TAHP’s presentation to the Senate Business and Commerce Committee takes an in-depth look into balance billing, and includes TAHP’s recommendations to expand mediation protection for consumers for out-of-network emergency care services — providers and facilities.

The Value of Health Plan Networks Presentation

Presentation on the commercial health insurance market in Texas, including trends and regulatory requirements.

January 2016

This in-depth presentation covers the types of health insurance available, the latest consumer trends in the health insurance market, and the consumer protections against balance billing.